modified business tax return instructions

Maximum threshold cost of section 179 property before reduction in limitation calculation. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the employer and certain wages paid to qualified veterans.

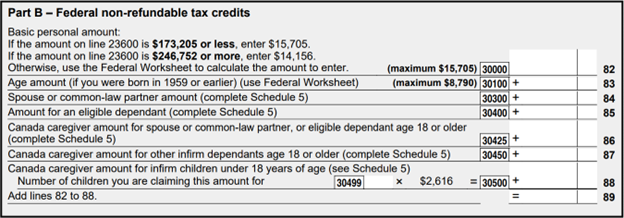

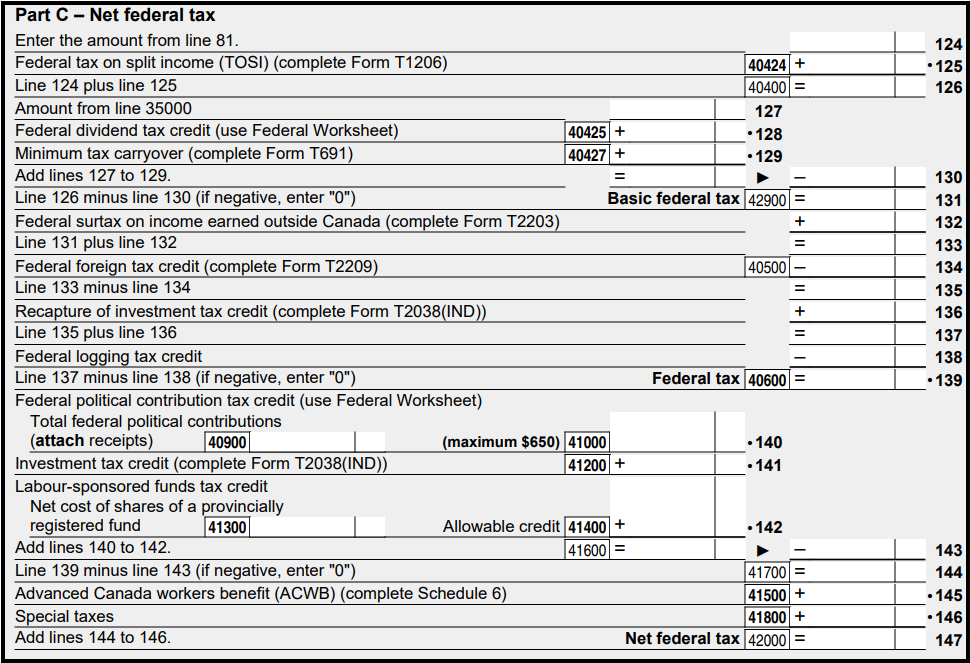

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

To get started on the blank use the Fill camp.

. Modified Business Tax NRS 463370 Gaming License Fees. Other rental income or loss from a section 162 trade or business reported on Schedule K. The Nevada Modified Business Return is an easy form to complete.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU. The modified business tax covers total gross wages less employee health care benefits paid by the employer. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed.

Modified Adjusted Gross Income MAGI. You can find the appropriate address on Page 3 of the instructions for Form 1120s. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately. In 2020 they are due July 15 because of COVID-19.

To amend a tax return for an S corporation create a copy of the original return on Form 1120-S and check Box H 4 Amended Return on the copy. At enrollment the Marketplace may have referred to APTC as your subsidy or tax credit or advance payment. If you dont however have this information readily available this simple form can end up taking hours to complete.

Child tax cedit or the cr edit for other dependents such as the r foreign tax cedit education cr edits or general business cr editr Owe other taxes such as self-employment tax household employment taxes additional tax on IRAs or other quali ed retiement plans and tax-favor ed accountsr. Use this as your opportunity to get. Most requests will be processed within 10 business days.

Page Last Reviewed or Updated. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. Instructions for Form 1040 Form W-9.

Modified Business Tax Return-General Businesses 7-1-16 to Current. Schedule 1 Part I Schedule 1 Part II Schedule 2. The Michigan Business Tax MBT which was signed into law by Governor Jennifer M.

Granholm July 12 2007 imposes a 495 business income tax and a modified gross receipts tax at the rate of 08. Business tax returns are typically due on March 15. If the sum of all taxable wages after health.

File an amended return on Form 1120s by sending the return along with any schedules that changed to the address where the original S corporation tax return was filed. Individual Tax Return Form 1040 Instructions. BUSINESS TAX GENERAL BUSINESS.

Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter. Then use the copy to make the changes to the return and re-file. POPULAR FORMS.

How you can complete the Nevada modified business tax return form on the web. Attach Form 8960 to your return if your modified adjusted gross income MAGI is greater than the applicable threshold amount. Enter the smaller of line 1 or line 2 here.

If the sum of all wages for the 915 quarter. Do not enter an amount less than zero. Your modified adjusted gross income see the instructions for line 6.

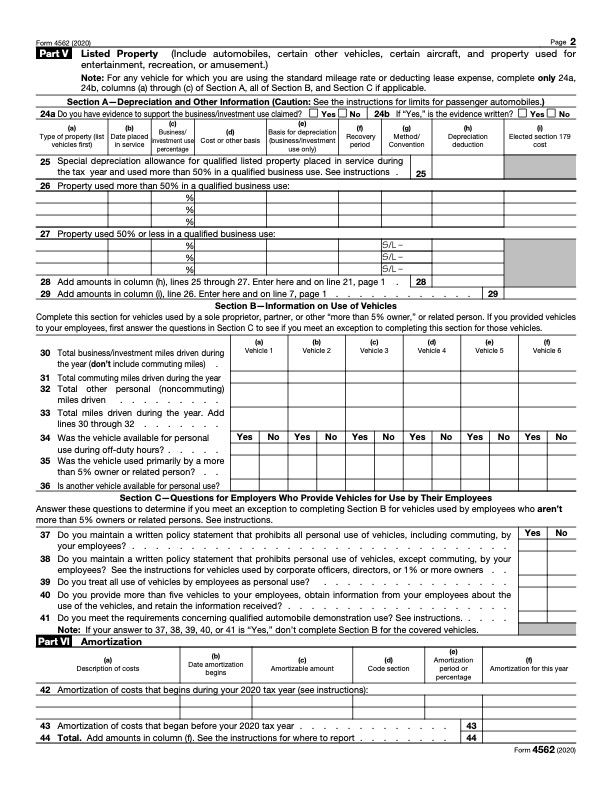

Enter the amount from line 3 here and on Form 4562 line 1. However the first 50000 of gross wages is not taxable. What is the Modified Business Tax.

Malt Beverage and Liquor Tax Forms. Motor and Alternative Fuel Tax Forms. SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117.

This is the standard. Companies that carry forward losses which exceed 1000 to 202122 must also lodge a tax return for 202021 even when no assessable income was derived in 202021. Keystone Opportunity Zone KOZ Forms.

The maximum section 179 deduction limitation for 2021. Learn more 2017 Instructions for Form 1045 - Internal Revenue. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the PTC you must file Form 8962 and attach it to your tax return Form 1040 1040-SR or 1040-NR. Enter the amount from line 1 here and on Form 4562 line 2. Sign Online button or tick the preview image of the blank.

The advanced tools of the editor will lead you through the editable PDF template. Taxable wages x 2 02 the tax due. The MBT replaces the Single Business Tax effective January 1 2008.

See the instructions for the tax return with which this form is filed. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line. Insurance companies and financial institutions pay alternate taxes see below.

MAGI can vary depending on the tax benefit. Medical Marijuana Tax Forms. Non-profit companies that are resident and have taxable income of 416 or.

Other Tobacco Products Tax Forms. The IRS uses your MAGI to determine your eligibility for certain deductions credits and retirement plans. Enter your official contact and identification details.

Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter. It requires data and information you should have on-hand. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line.

Modified Adjusted Gross Income MAGI in the simplest terms is your Adjusted Gross Income AGI plus a few items like exempt or excluded income and certain deductions. The rental property was mainly used in the trade or business activity during the tax year or during at least 2 of the 5 preceding tax years and. If the change in your S corporation taxes results in a change to shareholder information you must also file an amended Schedule K.

Companies that derived assessable income in 202021 must lodge a tax return for 202021. Gross wages payments made and individual employee information. Exceptions to this are employers of exempt organizations and employers with household employees only.

Learn more Form 4506-T Request for Transcript of Tax Return. Additionally the new threshold is decreased from 85000 to 50000 per quarter.

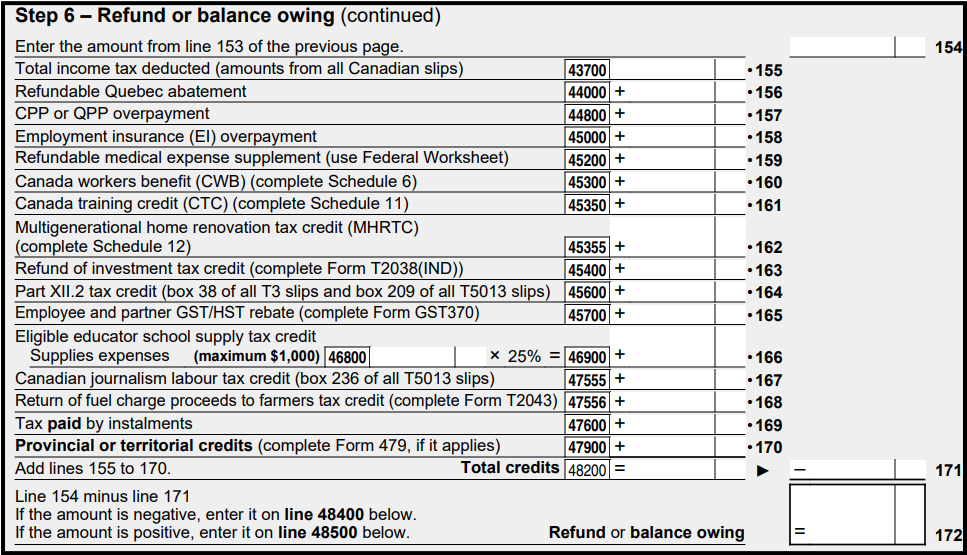

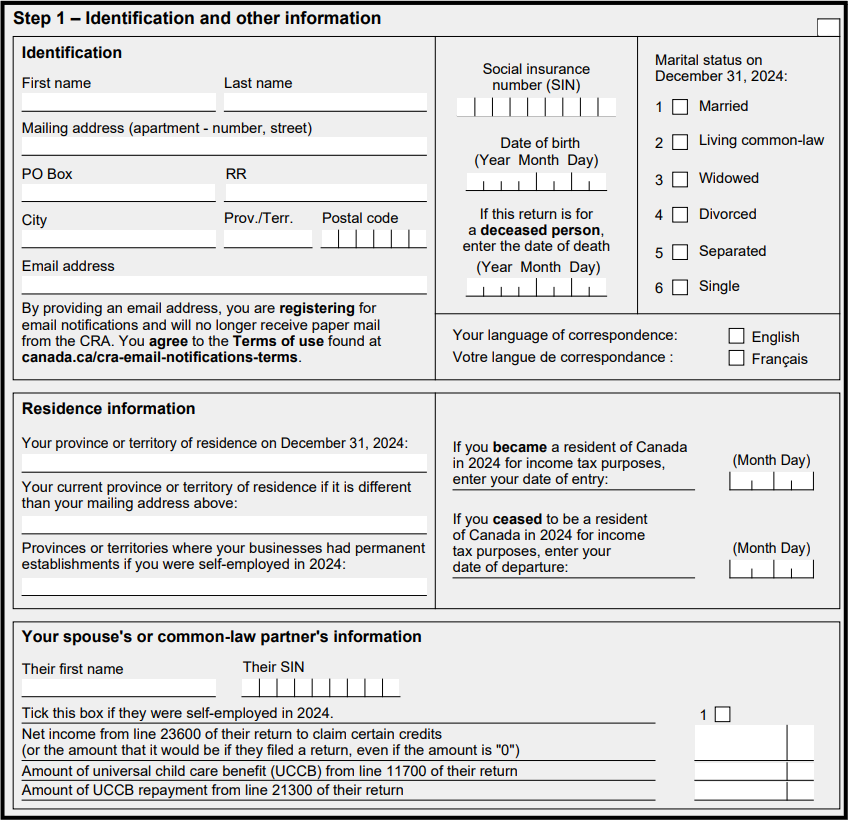

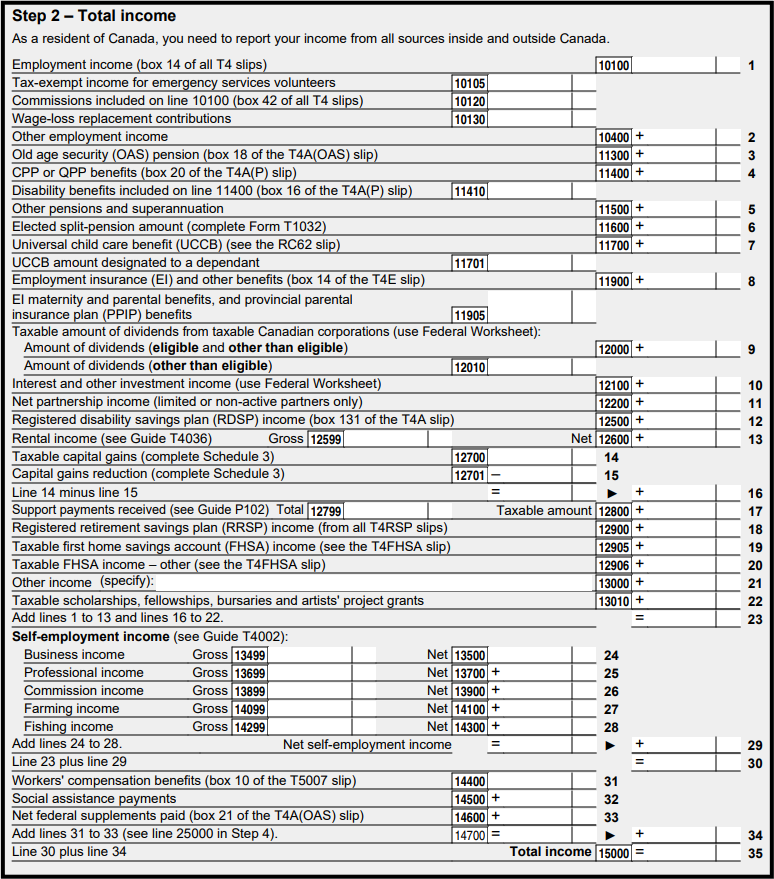

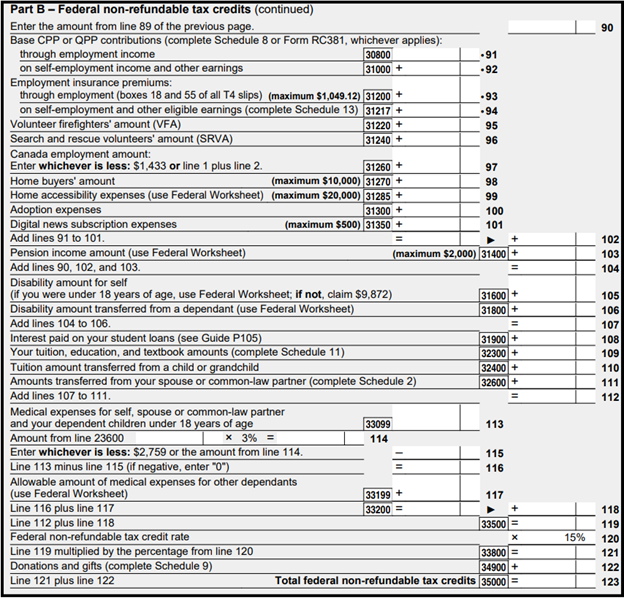

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

3 21 3 Individual Income Tax Returns Internal Revenue Service

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Tax Time 10 Most Common Irs Forms Explained

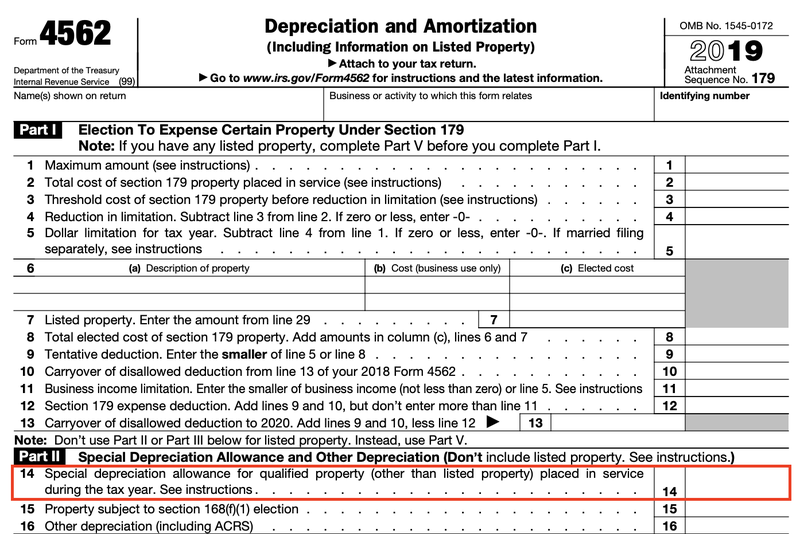

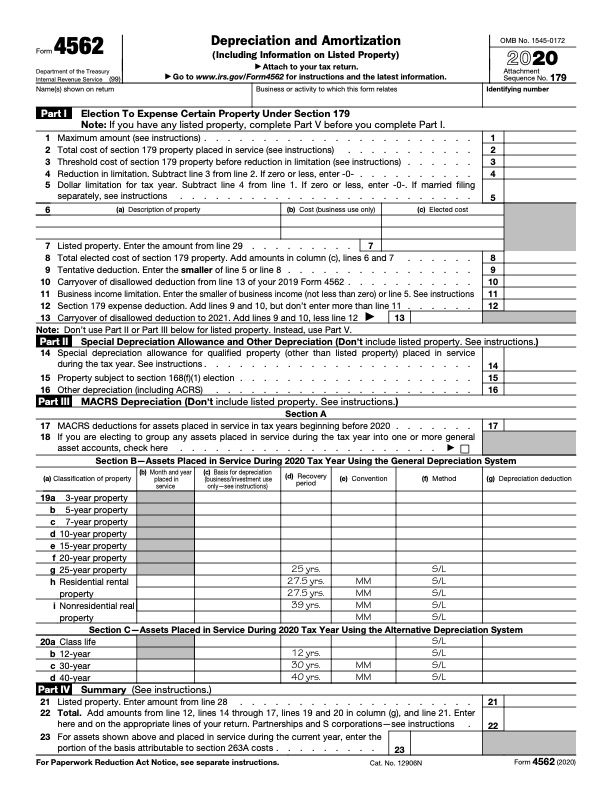

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

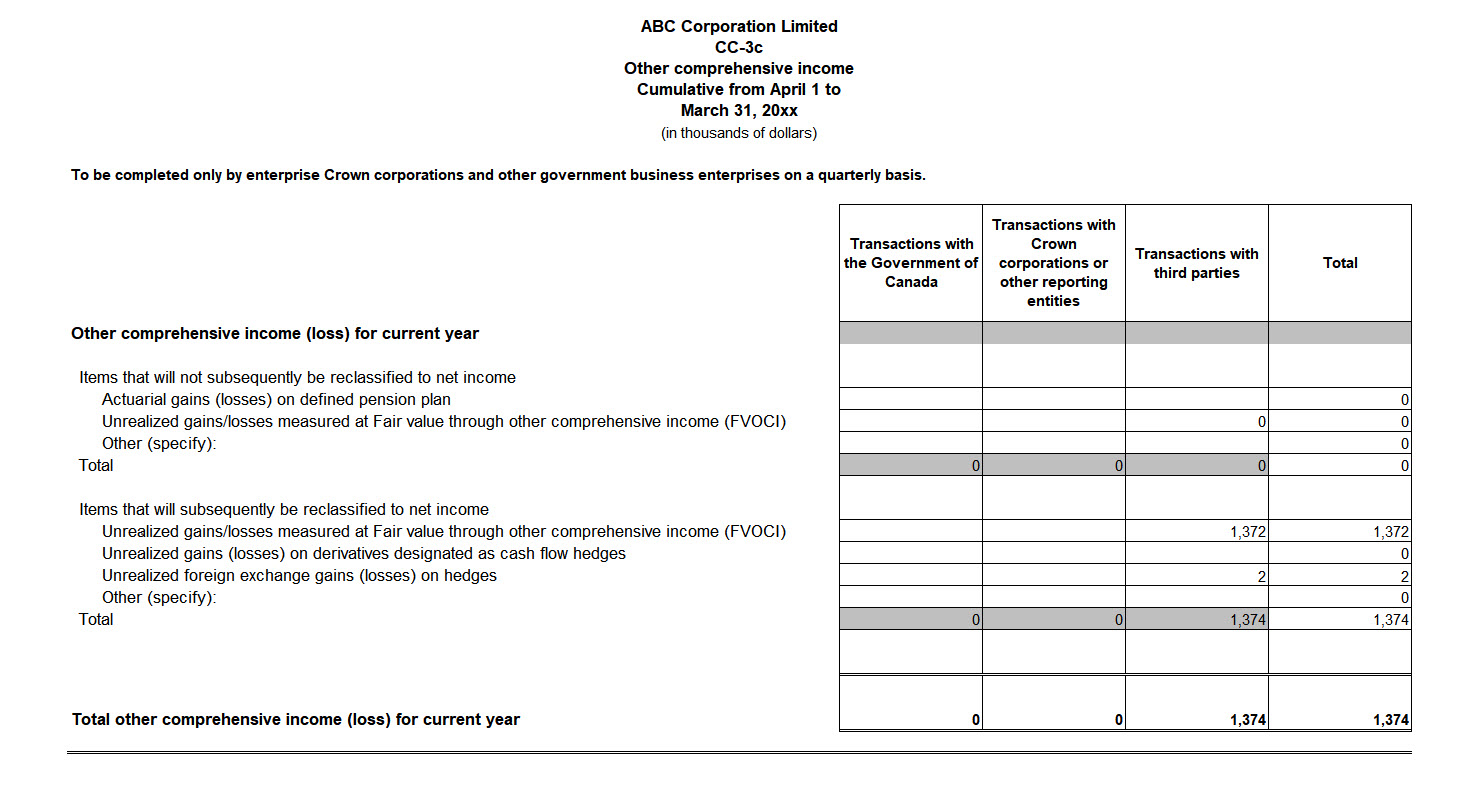

Reporting Instructions For Crown Corporations And Other Reporting Entities

What Is Bonus Depreciation A Small Business Guide The Blueprint

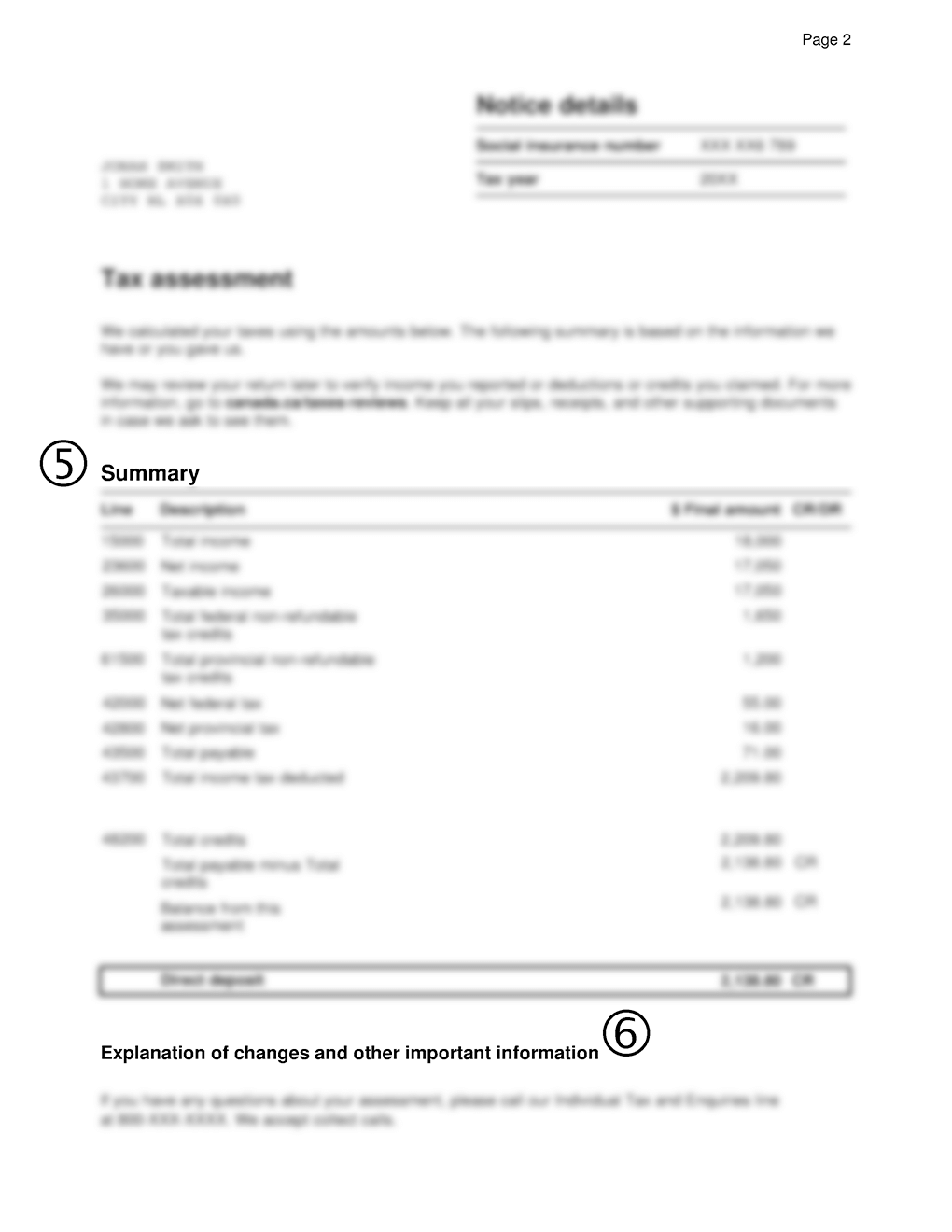

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting